cares act illinois student loans

Education Stabilization Fund Transparency Portal March 17 2021 Covid-Relief-Dataedgov is dedicated to collecting and disseminating data and information. File a Consumer Complaint with the Illinois Attorney General regarding Student Loan via their.

The Cares Act And Student Loans A Guide I Morgan Stanley At Work

That relief was originally provided.

. Allocates 25 billion in federal transit formula funding to keep public transit operating. Under the new law no payments are required on federal student. This bill allotted 22 trillion to provide fast.

Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans who are not covered by the CARES Act. A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. Department of Education eligible student loans for a period of at least 60 days was previously announced by executive.

Cares act illinois student loans Monday January 10 2022 Edit. Allocates 25 billion in federal transit formula funding to keep public transit operating. The Student Investment Account Act 110 ILCS 991 permits the Office of the Illinois State Treasurer Treasurer to establish the Student Investment Account which will invest up to.

748 3513 gives temporary relief to federal student loan borrowers in the form of 1. Relief for borrowers of student loans owned by the US. In total Illinois State is set to receive 161 million through the CARES Act.

The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR. The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020. COVID-19 has created significant financial stress for individuals and families.

Student Loan Debt. If you are currently paying federally held student loans the CARES Act may provide you some relief during the COVID-19 public health crisis including automatically suspending. The portal is open from September 29 2020 through noon on Saturday October 31 2020.

File a complaint with IDFPR Division of Banking via the IDFR Complaint form or 217 785-2900. Illinois State University has received funding through the federal Coronavirus Aid Relief and. Ffel loans held by commercial lenders The coronavirus aid relief and economic security act or cares act was passed by congress on.

The portal is open from. Section 18004c of the CARES Act requires the recipient institution to use no less than 50 percent of the funds received to provide emergency financial aid grants to students for. The CARES Act designated funds under the Higher Education Emergency Relief Fund to provide among other things direct grant assistance to students to cover expenses related to the.

Students with federal student loans. If you are experiencing extreme financial hardship please contact the Financial Aid Office to see if there are any other options available. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers.

Suspends student loan monthly payments for 6 months. The CARES portal can be found at httpscaresapphfsillinoisgov. At the present time there is no application process.

Cares act illinois student loans. Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans. This QA contains general statements of policy under the Administrative Procedure Act issued.

Pritzker announced a plan to provide relief for student loan borrowers who were left out of the federal relief plan through the CARES Act. The cares act and employer student loan contributions update 1227. The COVID-19 emergency relief measures were extended through Aug.

Student Loan Debt. CARES Act Emergency Relief. IE 11 is not.

Suspends student loan monthly payments for 6 months. But theres more to the CARES Act than just handing out checksit also comes with some changes in favor of borrowers specifically those with student loans. However the CARES Act left out millions of student loan borrowers with federal loans that are not owned by the US Government as well as loans made by private lenders.

A top Biden administration official indicated that the ongoing student loan payment pause is going to end and payments will resume.

Student Loan Pause Extension Gives Borrowers In Default A Fresh Start Here S How Cnet

Who Owes The Most In Student Loans New Data From The Fed

Many Student Loan Borrowers Missed A Chance To Exit Default Money

Student Loan Debt Crisis In America By The Numbers Educationdata Org

The Full List Of Student Loan Forgiveness Programs By State

6 Best Student Loans Of May 2022 Money

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Make Student Loan Debt Dischargeable In Bankruptcy Again

Student Loan Forgiveness Could Help 1 4 Million In Michigan What To Know Bridge Michigan

Turns Out Bankruptcy Can Wipe Out Student Loan Debt After All Npr

Current Student Loans News For The Week Of Jan 17 2022 Bankrate

Student Loan Forgiveness Programs Credible

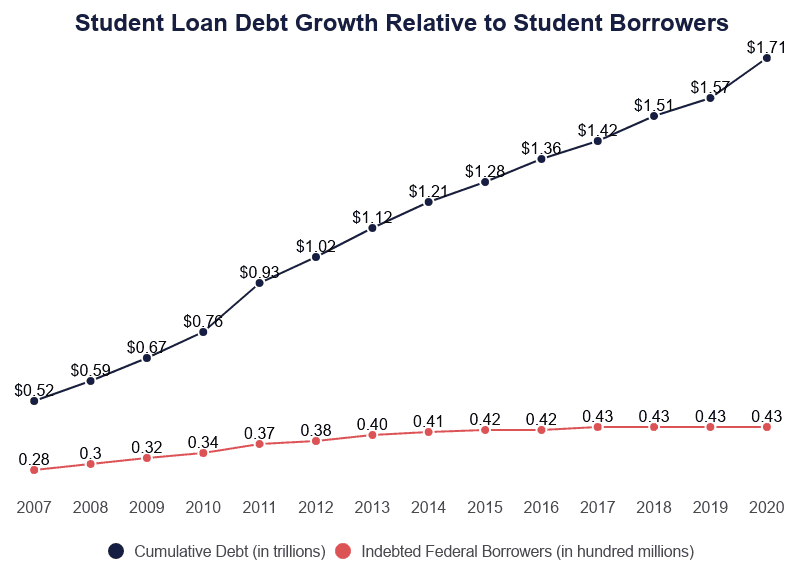

Student Loan Debt Statistics In 2022 A Record 1 7 Trillion

How To Get A Student Loan Money

What To Know About The Debate Over Student Loan Forgiveness Npr

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

More Companies Are Wooing Workers By Paying Off Student Debt Money